Our Vision

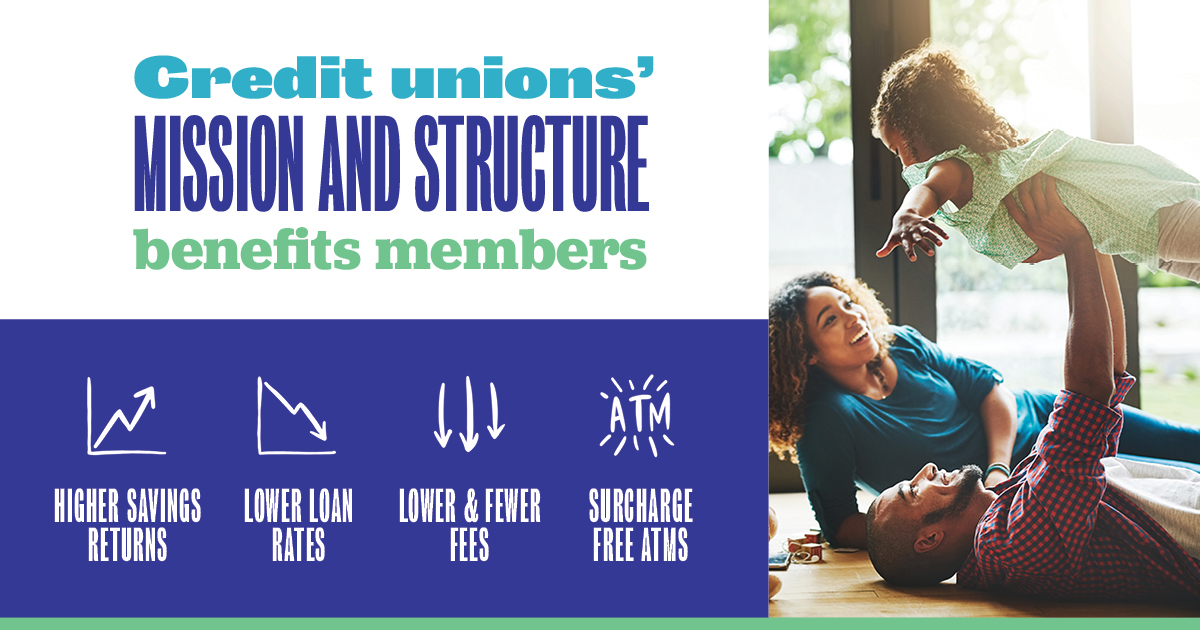

We strive to create a high-performance credit union committed to offering our members a competitive advantage on products and service compared to traditional lenders and big banks. Through our commitment to become our members’ primary financial institution, we shall consistently and constantly strive to assist members to attain their personal and professional financial goals with convenience and flexibility. We embrace and encourage volunteerism, educating our members, and community involvement.

Aspen Federal Credit Union began in a small janitor sized closet in the old Bennett-Clarkson Hospital. We started providing financial services and meeting the banking needs of the local Rapid City medical community. Over time, we have grown into a successful financial institution serving not only the Monument Health employees but all Rapid City and Black Hills surrounding areas!

To belong to our credit union, you must first become a member. The only requirement for membership is that you must live, work, or worship within Pennington, Meade, Custer or Lawrence Counties. That’s it!

As a member, you earn a dividend on your share account. A share account functions like a traditional bank savings account, but our dividend rate usually surpasses what other financial institutions can pay you. Once you become a member, you will remain a member as long as you maintain a share account with us.

Credit unions are non-profit thrift organizations that are member-owned. This means, as a member, you will always have a voice in the credit union’s operations. We have an annual meeting to which each member is invited. Be sure to stay tuned to our Facebook page so you can know when the annual meeting is coming up! Not on Facebook. We’ll also share the information in our quarterly newsletter.

We have a paid staff, although most of our direction comes from our Board of Directors and Supervisory Committee. Our Board of Directors and the Supervisory Committee members consist of well-respected and knowledgeable individuals who donate their time. They are people just like you, elected by our credit union members each year at our annual meeting.

Our Mission

Aspen Federal Credit Union is committed to providing personal service that is convenient, competitive, and caring; while maintaining financial stability to meet the changing needs of our membership.

Federal Insurance Accounts

Aspen Federal Credit Union is federally insured by the National Credit Union Share Insurance Fund (NCUSIF), which is backed by the full faith and credit of the United States Government. Established by Congress in 1970 to insure member share accounts at federally insured Credit Unions, the Fund is managed by NCUS under the direction of the three-person NCUA Board.

Your share insurance is similar to deposit insurance provided by the Federal Deposit Insurance Corporation (FDIC). Share accounts are insured up to $250,000, an amount equal to the insurance protection offered by the FDIC Generally, if a Credit Union member has more than one account in the same insured Credit Union, those accounts are added together and are insured up to the $250,000. There are exceptions, however. For more information about your insurance fund, please contact us at (605) 342-7776 or with an email.